Irs Due Dates 2024 – SNAP Texas Recertification Deadline: When do you need to renew in March 2024 before losing your fiscal year basis have different due dates. However, beyond the primary filing deadline, . The due date for quarterly taxpayers. This is for your estimated tax payments for the 4th quarter. This includes income you earned from Sept. 1 through Dec. 31, 2023. Jan. 29, 2024 Official beginning .

Irs Due Dates 2024

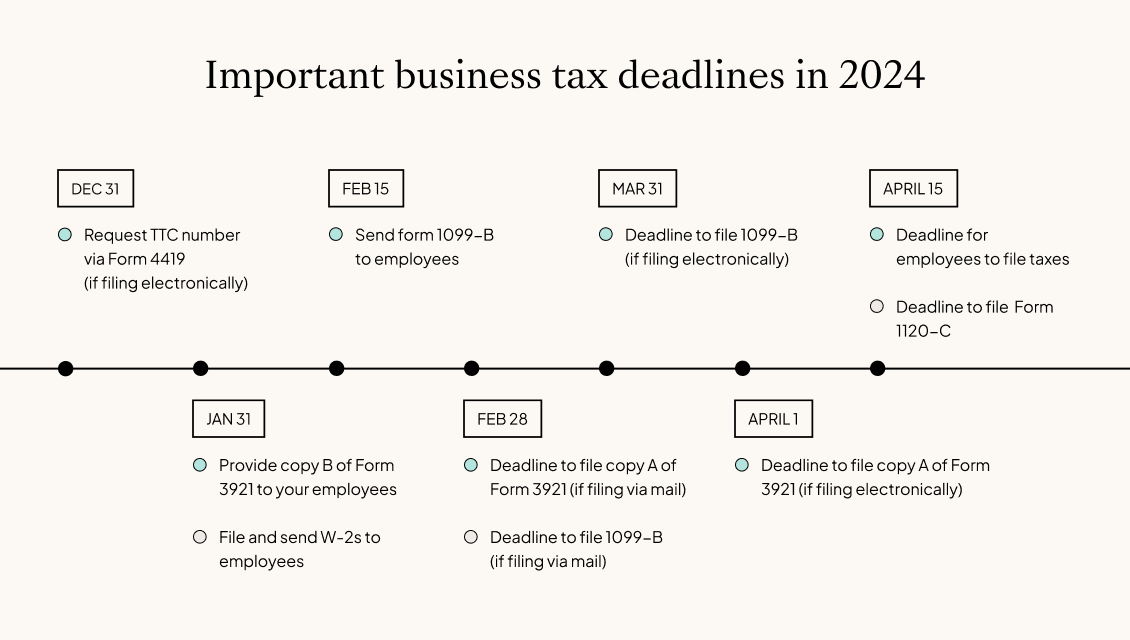

Source : carta.comTax Due Dates For 2024 (Including Estimated Taxes)

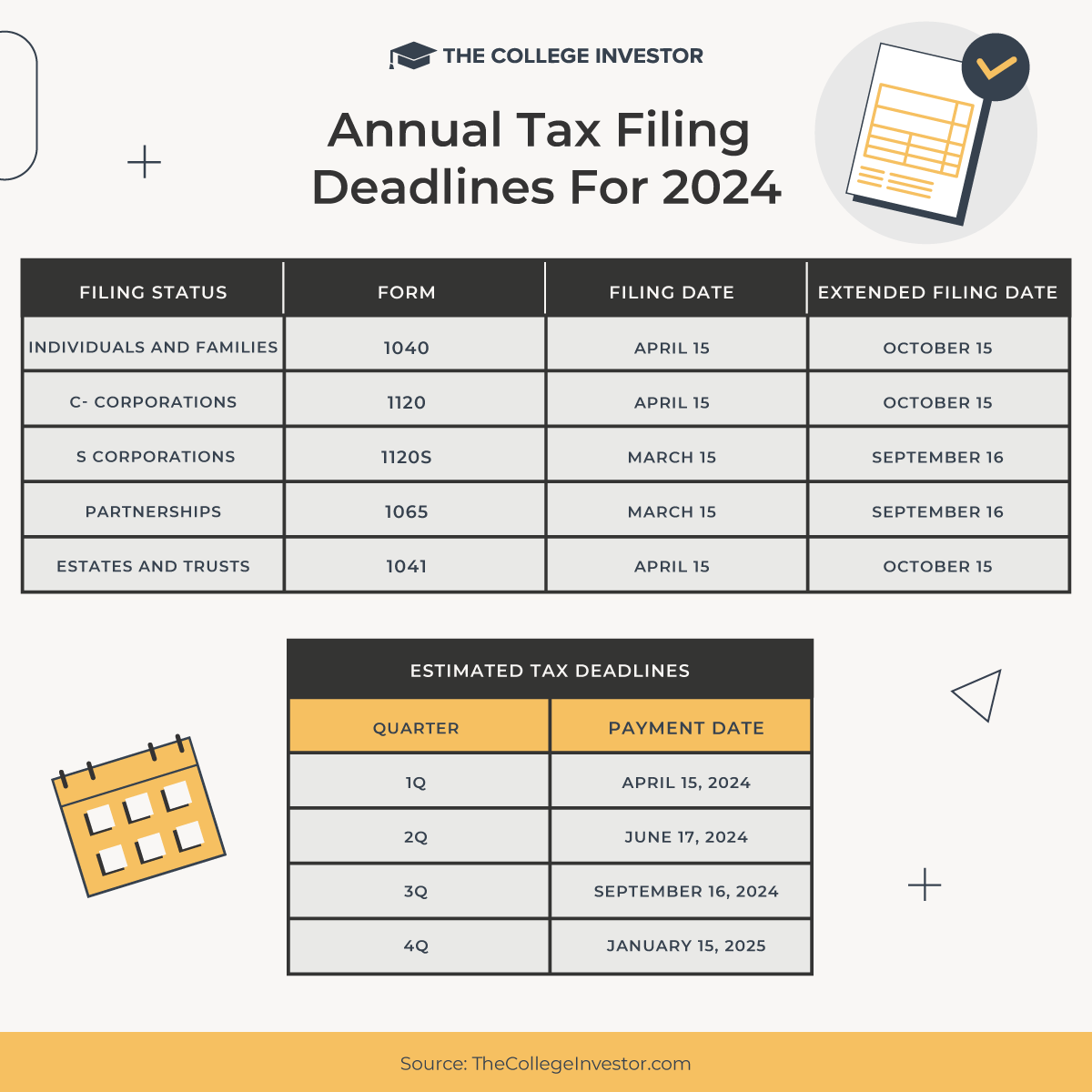

Source : thecollegeinvestor.com2023 1099, W 2 & ACA Filing Deadlines to the IRS and SSA – CUSTSUPP

Source : support.custsupp.comIRS Refund Schedule 2024 When To Expect Your Tax Refund

Source : thecollegeinvestor.comIt’s never too early to get prepared for the 2024 tax season

Source : www.instagram.comIRS Filing Start Date 2024 Deadline for Filing Electrically & on

Source : ncblpc.orgIRS Form 1099 NEC Due Date 2024 | Tax1099 Blog

Source : www.tax1099.comIRS Announces 2024 Tax Season Start Date, Filing Deadline | Money

Source : money.com✓ Tax Day Deadline for 2023 Taxes: e File by April 15, 2024

Source : www.efile.com2024 IRS Tax Deadlines Filing Calendar

Source : www.aarp.orgIrs Due Dates 2024 Business tax deadlines 2024: Corporations and LLCs | Carta: The US is in the middle of tax season, with the Internal Revenue Service busy receiving and processing tax returns for fiscal year 2023. According to IRS estimates, more than 128 million people are . By law, the IRS must wait until at least mid-February to issue refunds to taxpayers who claimed the earned income tax credit or additional child tax credit. According to the agency, those payments .

]]>